The IRS may deny or revoke your copyright if you owe a significant tax debt. This typically applies when your unpaid taxes exceed $54,000.

Navigating the intersection of IRS regulations and copyright eligibility can be complex. The IRS has specific guidelines regarding tax debts and copyright issuance. If you owe back taxes, the IRS may take action that affects your ability to travel internationally.

Understanding these policies is crucial for anyone planning to travel abroad. This ensures you maintain compliance with tax obligations while enjoying your journeys. By staying informed, you can avoid complications with your copyright and enjoy peace of mind during your travels. Always check the IRS guidelines to ensure you meet the necessary requirements before applying for or renewing your copyright.

Introduction To Irs And copyright Link

The connection between the IRS and passports is crucial for travelers. Understanding how your tax status impacts your copyright can save you trouble. This section explores the reasons behind this link and the basics of the IRS-copyright connection.

Why The Irs Is Involved

The IRS plays a key role in tax collection in the United States. They ensure citizens pay their taxes on time. If someone owes a significant amount of taxes, it can affect their copyright eligibility.

- The IRS can certify tax debts over $54,000.

- This certification can lead to copyright denial or revocation.

- The IRS aims to encourage tax compliance through this measure.

Basics Of The Irs-copyright Connection

The IRS and the copyright link involves specific rules. Here are the basics:

| Criteria | Description |

|---|---|

| Tax Debt Amount | Over $54,000 in unpaid taxes can affect your copyright. |

| Certification Process | The IRS certifies tax debts to the State Department. |

| copyright Actions | Possible denial or revocation of your copyright. |

It is essential to be aware of these rules. Staying informed can prevent issues with international travel.

Credit: www.irs.gov

Key Irs Notices For Travelers

Traveling can be exciting, but it comes with responsibilities. Understanding IRS notices is crucial for travelers. Some notices can affect your ability to obtain or renew a copyright. Below are important notices that travelers should know.

Notice Cp508c

The CP508C notice informs individuals about their tax status. It is specifically related to copyright applications. If you receive this notice, it means:

- You owe a serious tax debt.

- The IRS has reported your debt to the State Department.

- Your copyright may be denied or revoked.

This notice is a warning. It is essential to act quickly if you receive it. You can resolve your tax issues by:

- Paying the tax debt in full.

- Setting up a payment plan with the IRS.

- Getting a settlement through an Offer in Compromise.

Once your tax issues are resolved, the IRS will send a notice to the State Department. This will allow you to apply for or renew your copyright.

Understanding 'seriously Delinquent Tax Debt'

'Seriously Delinquent Tax Debt' refers to unpaid taxes. The IRS defines it as owing over $54,000. This includes penalties and interest. If you have this debt:

- Your copyright application may be denied.

- You cannot renew your current copyright.

- The IRS may inform the State Department about your status.

To avoid these issues, address your tax debts promptly. Options include:

| Action | Description |

|---|---|

| Pay in Full | Clear your tax balance completely. |

| Installment Agreement | Set up a plan to pay over time. |

| Offer in Compromise | Negotiate a lower amount to pay. |

Being informed about these notices helps you plan your travels. Stay updated to avoid copyright issues.

Consequences Of Ignoring Irs Debts

Ignoring IRS debts can lead to serious repercussions. The IRS has tools to enforce payment. One significant consequence is the impact on your copyright.

copyright Denial

The IRS can deny copyright applications for those with unpaid debts. If you owe more than $54,000 in taxes, your copyright request may be rejected. This includes:

- Tax liabilities

- Penalties

- Interest accrued on the debt

Traveling abroad becomes difficult without a valid copyright. Denial can affect personal and business trips. It’s crucial to resolve debts before applying for a copyright.

copyright Revocation

Existing passports can be revoked due to unpaid taxes. The IRS will notify the State Department. They will then cancel your copyright. This process can happen if:

- Your tax debt exceeds $54,000

- You fail to make payment arrangements

Revocation can disrupt travel plans. You may face legal issues if traveling internationally. Resolving your tax debts is essential to keep your copyright valid.

copyright Limitations

Even if your copyright remains valid, there may be limitations. Some countries may deny entry if they see tax issues. Traveling could become complicated and stressful. Here are a few limitations you might face:

- Increased scrutiny at border control

- Potential denial of entry into certain countries

- Difficulty in securing travel visas

Staying on top of your tax obligations is vital. Avoiding IRS debts protects your travel freedom.

Steps To Resolve Tax Debts

Dealing with tax debts can be overwhelming. The IRS offers several options to help taxpayers settle their debts. Understanding these options can provide relief and clear your tax record.

Setting Up A Payment Plan

A payment plan allows you to pay your tax debt in installments. This can make it easier to manage your finances. Here’s how to set it up:

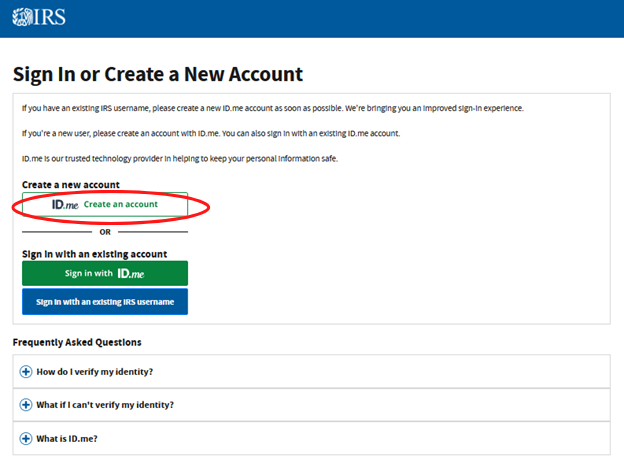

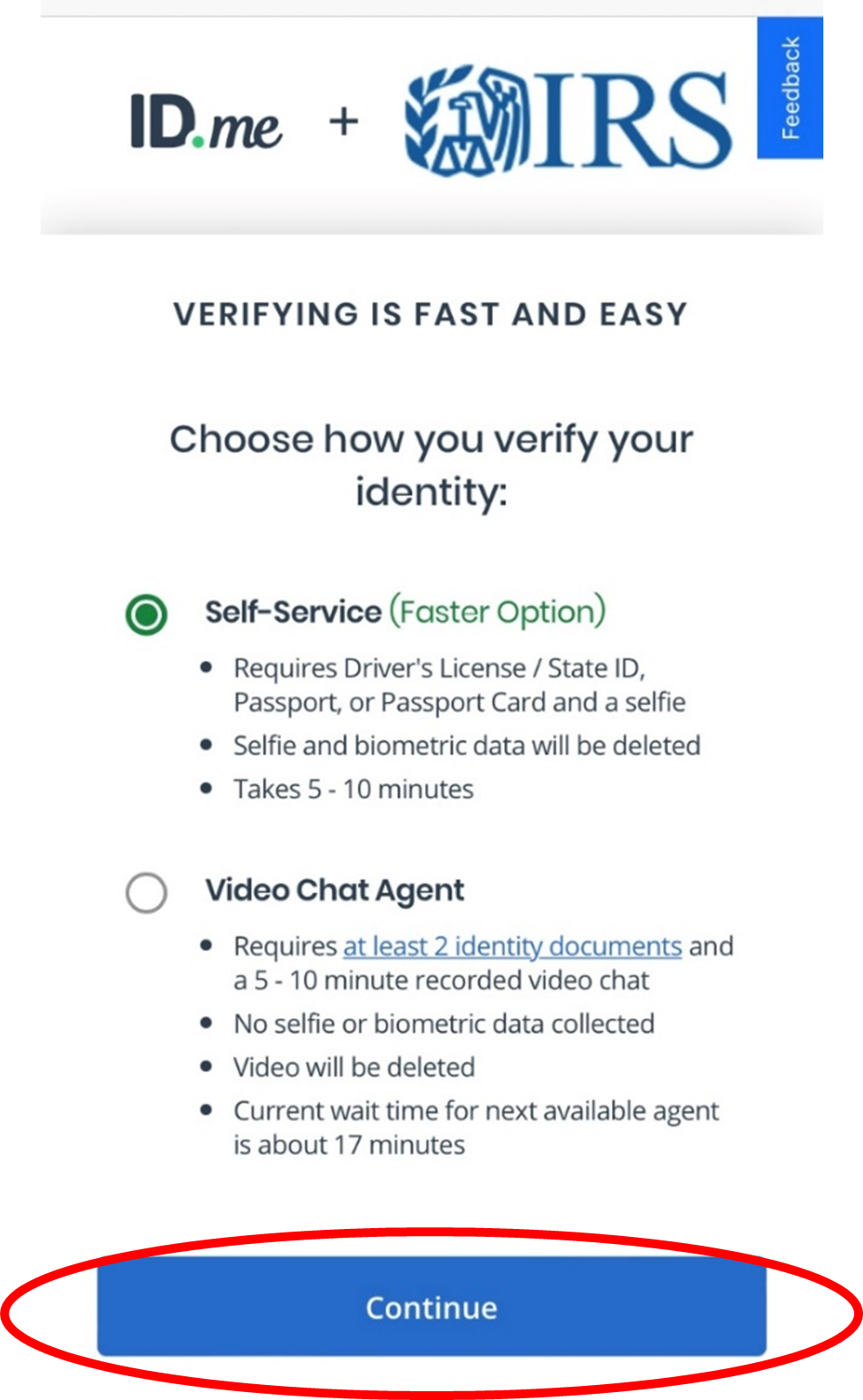

- Visit the IRS website.

- Complete the Online Payment Agreement application.

- Provide your personal and financial information.

- Choose a monthly payment amount.

- Submit your application.

Monthly payments depend on your total tax debt. The IRS will notify you once your plan is approved.

Offer In Compromise

An Offer in Compromise (OIC) allows you to settle your tax debt for less than you owe. This option is suitable for those who can’t pay the full amount. Follow these steps:

- Check if you qualify for an OIC.

- Complete the OIC application form.

- Provide supporting financial documents.

- Submit your offer with a payment.

The IRS reviews your application. They will consider your ability to pay.

Seeking Professional Help

Sometimes, professional help is the best option. Tax professionals can guide you through the process. Here are some benefits:

- Expert advice on tax laws.

- Help with paperwork and applications.

- Negotiation with the IRS on your behalf.

Choose a reputable tax professional. Ensure they have experience in resolving tax debts.

Preventing copyright Issues

copyright issues can create significant stress. The IRS can deny your copyright application or renewal if you owe taxes. Understanding how to prevent these problems is crucial. Here are key strategies to avoid copyright issues.

Regular Tax Filing

Filing your taxes on time is essential. Regular tax filing helps keep you in good standing with the IRS. Here are some tips:

- Set reminders for tax deadlines.

- File your taxes electronically for quicker processing.

- Consider hiring a tax professional if needed.

Staying current with your tax filings prevents complications. The IRS tracks tax compliance closely.

Monitoring Irs Notices

Keep an eye on any notices from the IRS. These notifications may include important information about your tax status. Actions to take:

- Check your mail regularly for IRS letters.

- Read each notice carefully.

- Respond promptly to any requests or issues.

Immediate attention to IRS notices can prevent larger problems. Ignoring them may lead to copyright restrictions.

Clearing Debts Promptly

Pay off any tax debts as soon as possible. The IRS can take action against your copyright if you owe money. Here are some ways to manage tax debts:

| Action | Description |

|---|---|

| Payment Plan | Set up a payment plan with the IRS. |

| Offer in Compromise | Negotiate to settle your debt for less. |

| Seek Help | Contact a tax professional for advice. |

Taking action on debts can protect your copyright status. Staying proactive is key to avoiding issues.

Restoring Your copyright

Having your copyright revoked can be stressful. The IRS can deny copyright applications for tax debts. Fortunately, there are ways to restore your copyright. This guide covers essential steps to regain your travel document.

Paying The Debt In Full

One straightforward way to restore your copyright is to pay your tax debt in full. Here are the steps to follow:

- Check your IRS account for outstanding debts.

- Make a full payment using IRS online payment options.

- Keep receipts and confirmation numbers for your records.

Once the IRS confirms your payment, they will update your account. This allows you to reapply for your copyright.

Negotiating With The Irs

If paying in full is not possible, consider negotiating with the IRS. Options include:

- Installment Agreement: Set up a payment plan to pay off your debt over time.

- Offer in Compromise: Propose a reduced payment amount to settle your tax debt.

Contact the IRS to discuss your situation. They may provide flexible options to help you manage your debt.

Legal Avenues For Disputes

If you believe the tax debt is incorrect, you can dispute it. Follow these steps:

- Gather all relevant documents and evidence.

- File a formal dispute with the IRS.

- Consult a tax attorney if needed.

Disputing your tax debt can take time. Be patient and keep track of all communications. Once resolved, you can move forward with your copyright application.

Travel Planning With Irs Debts

Planning a trip while having IRS debts can be tricky. The IRS can take action against you, including copyright restrictions. Understanding your tax status is crucial before booking any travel plans.

Checking Your Tax Status

First, you must check your tax status. This helps you know if there are any issues with your taxes. Follow these steps:

- Visit the IRS website.

- Log in to your IRS account.

- Review your tax balance and any outstanding debts.

If you owe money, you might face travel restrictions. The IRS can notify the State Department. This can affect your copyright and travel plans.

Communicating With The State Department

Next, communicate with the State Department. If you have IRS debts, they may restrict your copyright. To resolve this:

- Call the State Department’s copyright services.

- Explain your situation clearly.

- Ask about any restrictions on your copyright.

Take the time to understand their policies. You may need to settle your debts before traveling.

Alternative Travel Documents

If your copyright is restricted, consider alternative travel documents. Options include:

| Document Type | Notes |

|---|---|

| State ID | Good for domestic travel only. |

| Enhanced copyright | Valid for travel to copyright and Mexico. |

| Travel Letter | May be issued for specific situations. |

Explore these options if your copyright is unavailable. Always keep your documents up to date.

Credit: www.taxoutreach.org

Real-life Stories And Tips

Understanding IRS.gov passports can be easier with real-life experiences. Stories from others provide insight and clarity. Tips from those who faced challenges can help avoid common mistakes.

Success Stories

Many individuals have successfully navigated IRS.gov copyright issues. Here are a few inspiring examples:

- Maria's Triumph: After years of unpaid taxes, Maria took action. She set up a payment plan with the IRS. Her copyright application was approved quickly.

- John's Journey: John faced copyright denial due to tax debt. He sought help from a tax professional. With proper guidance, he resolved his issues and received his copyright.

- Alice's Advocacy: Alice worked hard to pay off her debts. She documented every payment. The IRS recognized her efforts and granted her copyright.

Common Pitfalls To Avoid

Avoid these common mistakes when dealing with IRS.gov copyright issues:

- Ignoring IRS notices. Always read and respond promptly.

- Delaying tax payments. Set up a payment plan early.

- Neglecting to keep records. Document all communications and payments.

- Overlooking deadlines. Stay aware of important dates.

Expert Advice

Experts share valuable tips for dealing with IRS copyright issues:

- Consult a tax professional for personalized guidance.

- Contact the IRS directly for specific questions.

- Stay organized. Keep all tax documents in one place.

- Use IRS online tools for easy access to information.

Follow these tips to navigate the IRS.gov copyright process smoothly.

Credit: www.taxoutreach.org

Frequently Asked Questions

What Is The Irs.gov copyright Program?

The IRS. gov copyright Program helps the IRS communicate with taxpayers. It allows for easier processing of tax-related matters involving passports. If you owe taxes, the IRS may notify the State Department to deny or revoke your copyright. Staying informed can help you avoid travel disruptions.

How Does The Irs Affect My copyright Application?

If you owe a significant tax debt, the IRS can impact your copyright application. The State Department may deny or revoke your copyright if your tax balance exceeds $54,000. It’s essential to resolve any tax issues before applying for or renewing your copyright.

Can I Get A copyright If I Owe Taxes?

Yes, you can still get a copyright if you owe taxes. However, if your tax debt is substantial, the IRS may notify the State Department. This could lead to a copyright denial or revocation, so it’s wise to pay your tax obligations promptly.

How To Resolve Irs copyright Issues?

To resolve IRS copyright issues, you should pay your tax debt. You can also set up a payment plan with the IRS. If you believe there’s an error, contact the IRS directly. Resolving these issues promptly can help restore your copyright eligibility.

Conclusion

Understanding IRS. gov and its copyright policies is essential for travelers. Knowing how tax obligations can affect your copyright status helps you plan better. Staying informed ensures you won’t face unexpected issues while traveling. Always check the IRS website for the latest updates and guidelines.

Safe travels await you!